Forex Facts for Traders

Forex Facts for Traders Successful forex traders make modest gains Most of the …

Website: https://www.trading.com

Trading.com is a brand new CFD trading broker that was launched in July 2019 by Trading Point Group, the parent company of XM. With the backing of one of the leading global forex brokers Trading.com quickly made a splash, and is being adopted rapidly by traders.

Currently Trading.com provides services only to residents of the European Economic Area (EEA) based on its licensing in the U.K. by the Financial Conduct Authority. Eventually the site plans on becoming licensed by the National Futures Association as well, at which time it will join the likes of IG, Forex.com, and OANDA in offering forex trading in the U.S.

Keep in mind that the NFA requires a minimum operational capital of $20 million, which has effectively kept small and mid-sized brokers out of the U.S. markets. That means there is a large and lucrative slice of business to be captured by those able to become licensed in the U.S.

The parent company was launched a decade ago in 2009 by a group of ex-interbank dealers. Originally branded as XEMarkets, the rebranded XM has become known globally as one of the top forex and CFD brokers. Clients appreciate the wide array of assets available, not to mention the excellent trading conditions.

Trading.com is following that path as well, offering tight spreads and no commissions, the technologically advanced MetaTrader 5 platform, and six asset classes. Plus it has a low minimum deposit of just $5 to get started, 30:1 leverage, and a demo account to familiarize yourself with the platform and Trading.com’s trading conditions.

As part of the research process to write this review, we set up a demo account with Trading.com and accessed their website, desktop, and their mobile trading platform. The process of opening a demo account was straight-forward and quick, taking just 60 seconds. They also say it takes just 4.5 minutes to open a real account.

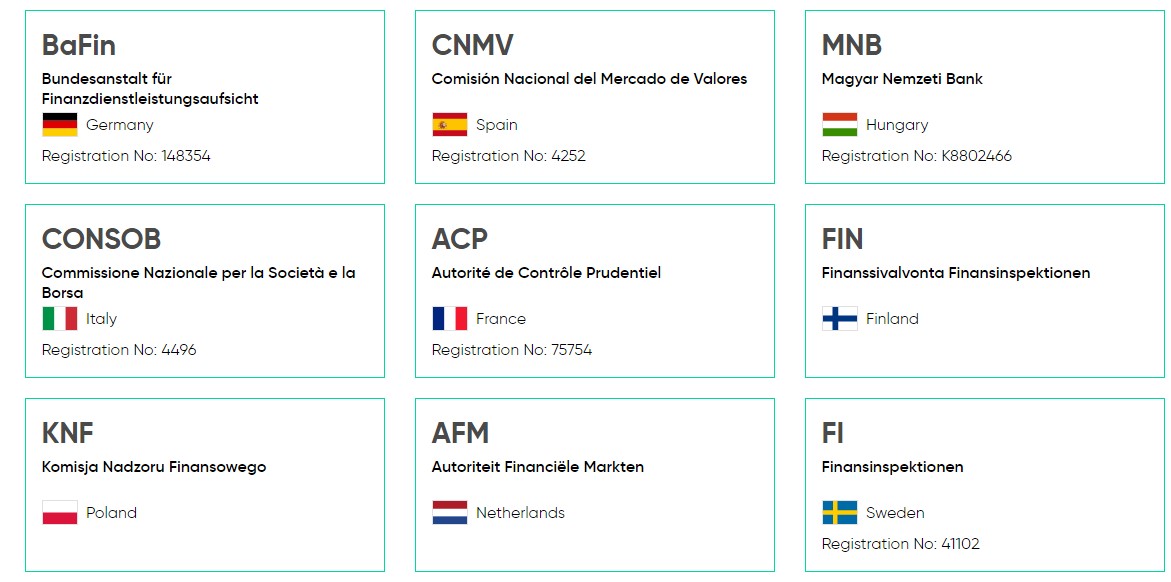

Trading.com is part of a large family of companies in the XM Group. The XM Group comprises Trading Point of Financial Instruments Ltd., which is regulated by the Cyprus Securities and Exchange Commission (CySEC 120/10), Trading Point of Financial Instruments Pty Ltd., which is licensed by the Australian Securities and Investments Commission (ASIC443670) and Trading Point of Financial Instruments UK Ltd., a company authorized by the UK’s Financial Conduct Authority (FCA705428). The XM family also includes XM Global and XMTrading, which are registered offshore.

Of course the relevant part is that Trading Point of Financial Instruments UK Ltd., which operates Trading.com, is authorized and regulated by the Financial Conduct Authority (FCA) in the U.K. (FCA705428).

Trading Point of Financial Instruments UK Ltd is regulated by the Financial Conduct Authority

(Reference number: 705428)

When signing up for a demo account we were offered a choice of 11 different languages (English, Czech, Dutch, French, German, Hungarian, Italian, Polish, Portuguese, Spanish, and Swedish). The Trading.com website is available in the same 11 languages, and the MT5 trading platform is available in dozens of different languages.

Trading.com offers two accounts type – the Ultra-Low Standard, which uses 100,000 units of the base currency as a standard lot, and the Ultra-Low Micro, which uses just 1,000 units of the base currency as the standard lot. In either case you can open a live account with as little as $5, and in both cases you’ll get leverage up to 30:1, which is the greatest allowed by the ESMA regulations. Of course if you can prove that you’re a professional trader you can get greater leverage.

Demo accounts are available to everyone at Trading.com, and the demo accounts never expire, although they will be inactivated if not used in 90 consecutive days. You get full access to all the same features as a real account, and $100,000 in virtual funds to test to your heart’s content. Plus it takes just a minute to register the demo account and get started.

Spreads as low as 0.6 pips for the EUR/USD pair, and we can confirm this is the spread on that pair on the demo platform, which is supposed to have the same price feed as the live account. Spreads are variable, but seem fair across all the assets being offered by Trading.com.

There are no commissions to consider, and the only other fees we could find is an inactivity fee for accounts that have been dormant for 90 days and a fee for those who would like to use VPS. The inactivity fee is $5 or the balance in the account if it is less than $5. If the account balance is $0 there is no inactivity fee charged. The VPS fee is $28 a month, unless the client has a balance above $5,000 and trades a minimum of 5 round turn lots per month, in which case the VPS is free.

Clients can also run into charges for swaps on trades they hold overnight. Again these swap fees are variable, and swaps can also be a credit to your account depending on the currency pair.

Deposits can be made via bank transfer, credit/debit card, and a number of electronic wallet options. There are no fees for deposits at Trading.com, and clients can deposit in any currency and it will be converted to the base currency of the account at the prevailing interbank rates. With the exception of bank transfers, which can take up to 5 business days, all deposits are credited immediately.

Withdrawals can be made via bank transfer, credit/debit card, and a number of electronic wallet options. There are no fees for withdrawals at Trading.com, and Trading.com will cover any fees imposed by the bank/credit card/electronic wallet, as long as the withdrawal exceeds $200. Withdrawals are processed by the back office within 24 hours and are credited to electronic wallets within 24 hours. Withdrawals by bank transfer or credit card can take from 2-5 days to be credited to your account.

In all cases you can only deposit from and withdraw to an account that is in your name. Also it is not possible to make transfers between two accounts.

Trading.com uses the MetaTrader 5 platform exclusively and makes the platform available to clients as a desktop application, a web-based application, and a mobile application (for both Android and iOS). MetaTrader 5 is a technologically advanced award-winning forex trading platform, and clients will find it is loaded with features, especially when it comes to technical analysis and chart-based trading strategies.

The MetaTrader 5 web-based platform is full-featured and has all the powerful charting features and indicators traders need to analyze market price action. Clients can take advantage of the full range of languages, of MT5 built-in alerts, of the MT5 signal services and of the solid, reliable performance of the platform

The MetaTrader 5 Mobile Application is available for both Android and iOS mobile devices. In either case clients get full platform functionality on their mobile device, allowing trading to continue even when they have to be away from their computer.

Trading.com allows the use of Expert Advisors, but only via the desktop MetaTrader 5 platform. While that does mean the platform needs to be downloaded to the client’s personal computer, the availability of the Expert Advisors more than makes up for the inconvenience of installing a desktop application. One other limitation of MetaTrader 5 is that it is only available for Windows computers (Windows 7 or higher, Windows 10 strongly recommended.

Trading.com has over 1,250 different assets available to trade over six different asset classes. Trade forex, individual stocks, commodities, metals, energies and indices. There are more than 60 forex pairs available, including all the major pairs as well as many of the more exotic pairs. And you can also chose among 18 spot indices, 13 futures indices, as well as precious metals like silver, gold, platinum and palladium, various commodities including oil, natural gas, sugar, cocoa, coffee, cotton, wheat, high grade copper, corn and soybeans, and a comprehensive list of European and US stocks.

Traders can choose from four types of orders: limit orders, market orders, stop loss orders, and trailing stop orders.

The MetaTrader 5 platform can easily accommodate the use of price alerts, which can be sent to a mobile device via SMS, or to an email address. Traders can also set alerts to be triggered at the release of important economic news events, making sure never to miss a market moving event.

Traders have the basic risk management provided by the various order types.

Trading tools are primarily the vast variety of indicators and chart tools provided through the MetaTrader 5 platform. Trading.com also sends a daily email that details any activity in the traders account, including positions taken or closed, positions still open, profits and losses, deposits or withdrawals. We thought it was a nice feature and a good way to keep all account activity together and always available.

There is currently (December 2019) not an education or training area of the Trading.com website, however there is a placeholder for a trading guide that is coming soon. There is an economic calendar where traders can keep track of upcoming economic data releases and events, and there is also a set of forex calculators to make sure you don’t exceed margin requirements, to calculate pip values and swap amounts, and to calculate profit and loss. We’re sure the XM Group won’t overlook education and training for the traders.

Customer service is available on a 24/5 basis and in all 11 supported languages. You can reach out to the customer support team via live chat, telephone, fax, or email and based on our experience you’ll get a timely and knowledgeable response. Of course the online chat is the fastest way to get a response, but we also received a response to our email questions within an hour, which we feel is acceptable.

| Headquarters |

Citypoint Building, 1 Ropemaker Street, London, EC2Y 9HT, United Kingdom +44 2031501500 [email protected] |

| Website: | https://www.trading.com/ |

| Account Type: Flexible account types give you the option of choosing a pricing model that best suits your trading style. most have accounts that are Ideal for traders who want a traditional, spread pricing, currency trading experience or For traders who are seeking ultra-tight spreads with fixed commissions. and even some that are designed for serious high-volume FX traders looking for maximum control as a trader you have to decide what you need and find the broker tat provides that | ECN, No Dealing Desk |

| Account Currencies: A foreign exchange account, or Forex account, is used to hold and trade foreign currencies. Typically, you open an account, deposit money denominated in your home country currency, and then buy and sell currency pairs. so most brokers offer the larger currencies like the USD , GBP and EUR , some have others also depending on their locations and regulation | EUR USDEUR USD GBP AUD CHF PLN |

Spreads:

What is spread in Forex?It is basically the difference between buying and selling prices of the assets you are currently trading. For example, let’s imagine a USD/JPY trade. In this pair’s case, we are buying JPY with USD, so we need to calculate accordingly. The market is requesting a price of 109.77 JPY per USD, so we buy. There’s another person trying to sell his USD and he is seeing a price of 109.79 JPY per USD. Once the trade goes through each trader gets the according amount and the spread comes in to be at 2 pips. So 109.79-109.77= 0.02. But what is a spread in Forex trading? Why is there a gap between these prices? Well, it’s quite simple. The spread is usually an income source for the broker. Every broker has a “liquidity provider” who directs the trades to the market and helps both the broker and the trader make payouts.Those liquidity providers have their own spread as well, so if the broker wants to have at least some income, they either have to charge commissions on the traders, or mark the spread up. |

Variable Spreads |

| US Clients Accepted: | |

|

Deposit Methods:

Deposit Methods Planning to trade forex online? After you choose a broker and register an account, your very next step before you can trade will be to deposit funds. Most brokers offer a wide variety of deposit methods for your convenience. This article will help you understand deposit methods more fully so that you can choose the one which is best for your needs. This is an essential step to take if you want to keep your trading experience smooth, affordable and hassle-free. What is a Deposit Method? A deposit method is simply a means which is used to deposit money into your forex trading account. A related term is “withdrawal method,” which is the means used to withdraw money from your forex account. In many cases, the method you use for depositing money will also double as your withdrawal method. Most forex brokers provide a list of deposit and withdrawal methods they accept on their banking pages. There you should also be able to view transfer times and fees. Common Deposit Methods for Forex in 2021 In 2021, many different deposit methods are accepted for forex. Here are a few: Credit or debit card Bank transfer E-wallet (i.e. PayPal, Skrill, etc.) Prepaid cards (i.e. paysafecard) Check or money order Bitcoin or other cryptocurrencies On our site, you may read through detailed articles on all of these deposit method categories, as well as popular providers in each. Note that not all forex brokers offer the same list of deposit methods. Some may accept only a few different methods, while others may provide dozens of options. Fees, transfer times, and other details also may vary from one broker to the next. For that reason, it is very important to check out the banking information for any broker you are thinking of using before you sign up. |

Wire Transfer, Visa, MasterCard, Skrill |

Trading Platforms

What Is a Trading Platform?A trading platform is software used for trading: opening, closing, and managing market positions through a financial intermediary such as an online broker. Online trading platforms are frequently offered by brokers either for free or at a discount rate in exchange for maintaining a funded account and/or making a specified number of trades per month. The best trading platforms offer a mix of robust features and low fees. There are two types of trading platforms: prop platforms and commercial platforms. As their name indicates, commercial platforms are targeted at day traders and retail investors. They are characterized by ease-of-use and an assortment of helpful features, such as news feeds and charts, for investor education and research. Prop platforms, on the other hand, are customized platforms developed by large brokerages to suit their specific requirements and trading style. |

MT5, Web Trading, |

| Supported OS: | Windows, Windows Phone,, Android, iPhone |

| Instruments- Range of Market Range of Market what are you able to trade here and what are the different financial asset categories that this broker offers, for example do they offer trading cryptocurrency or do they not, do they offer trading in gold etc. what are the majors and exotic pairs they have , | Forex, Indices, Precious Metals, Oil, Commodities, CFD Stocks, Cryptocurrencies | ||||||||||||

| Automated Trading Automated trading is a method of participating in financial markets by using a programme that executes pre-set rules for entering and exiting trades. As the trader, you’ll combine thorough technical analysis with setting parameters for your positions, such as orders to open, trailing stops and guaranteed stops. Auto trading enables you to carry out many trades in a small amount of time, with the added benefit of taking the emotion out of your trading decisions. That’s because all the rules of the trade are already built into the parameters you set. With some algorithms, you can even use your pre-determined strategies to follow trends and trade accordingly. | No | ||||||||||||

| Hedging Allowed Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets. There are two related strategies when talking about hedging forex pairs in this way. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. | |||||||||||||

Scalping Allowed

ScalpingScalping, when used in reference to trading in securities, commodities and foreign exchange, may refer to either a legitimate method of arbitrage of small price gaps created by the bid–ask spread, or a fraudulent form of market manipulation. How scalping worksThis section does not cite any sources. Please help improve this section by adding citations to reliable sources. Unsourced material may be challenged and removed. (March 2010) (Learn how and when to remove this template message) Scalping is the shortest time frame in trading and it exploits small changes in currency prices.[1] Scalpers attempt to act like traditional market makers or specialists. To make the spread means to buy at the Bid price and sell at the Ask price, in order to gain the bid/ask difference. This procedure allows for profit even when the bid and ask don't move at all, as long as there are traders who are willing to take market prices. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. The role of a scalper is actually the role of market makers or specialists who are to maintain the liquidity and order flow of a product of a market. The profit for each transaction is based only on a few pips (basis points), so scalping is typically conducted when there are large amounts of capital and high leverage or there are currency pairs where the bid–offer spread is narrow. |

|||||||||||||

Guaranteed Stops

What is a guaranteed stop?

Guaranteed stops

One way to ensure your stop is executed exactly where you specify is by placing a guaranteed stop. Guaranteed stops work in the same way as basic stops, except that they will always be filled at the level you set, even if prices move rapidly or gapping occurs.

If your guaranteed stop is triggered, you will incur a fee known as the stop premium on the closing of the trade.

To set a guaranteed stop on your deal or order ticket, click the drop-down arrow under ‘Stop’ and select ‘Guaranteed’.

Costs of a guaranteed stop

The stop premium varies depending on the market you are trading, and you’ll only be charged if the stop is triggered. You can see the guaranteed stop cost before opening a deal, as the stop premium will display near the bottom of the ticket. This premium is held separately alongside the margin, and if triggered will appear as an itemised charge in your history and overnight statement.

Benefits of using a guaranteed stop

In the event of a sudden, rapid market movement, an example of how a guaranteed stop can act like an insurance is shown below.

Let us consider three different clients, A, B and C, using different methods to manage their account.

All three clients have an open buy trade of £10 per point of USD/JPY at 11027.5. During the sudden fall in the value of USD/JPY on 2 January 2019 – known as a ‘flash crash’ – most clients were closed out at 10686.4, while the pair bottomed out at 10472.7. Here’s the impact on the three accounts:

Comparing the scenarios above, client A, who placed a guaranteed stop on their position, has greatly minimised their losses compared to clients B and C. If the flash crash had not happened, and the guaranteed stop had not been triggered, there would have been no impact on client A as the guaranteed stop premium would only have been charged if the stop was triggered.

Why am I unable to edit my guaranteed stop?

Generally, guaranteed stops can be edited after you add them. However, there are some scenarios in which you won’t be able to edit your guaranteed stops:

1. The market is closed

When the market is closed, you can only move your guaranteed stop further away (increasing your guaranteed stop distance). You will not be able to move your guaranteed stop nearer. 2. An increase in the minimum guaranteed stop distance During periods of increased or expected market volatility, we may increase the minimum guaranteed stop distance as compared to the initial guaranteed stop distance. In such situations you will have to adhere to the new guaranteed stop distance when amending your guaranteed stop. |

|||||||||||||

Trailing Stops

What Is a Trailing Stop?A trailing stop is a modification of a typical stop order that can be set at a defined percentage or dollar amount away from a security’s current market price. For a long position, an investor places a trailing stop loss below the current market price. For a short position, an investor places the trailing stop above the current market price. A trailing stop is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the investor’s favor. The order closes the trade if the price changes direction by a specified percentage or dollar amount. A trailing stop is typically placed at the same time the initial trade is placed, although it may also be placed after the trade. |

|||||||||||||

Interest on Margin

Interest on MarginA profit margin is a measure of how much money a company is making. In the world of futures trading, margin is a deposit that an investor puts down in order to enter a position. Meanwhile, in stock trading, margin is money borrowed from a broker. Beware before taking out one of these loans, however, as money borrowed in margin accounts will incur interest charges.Types of MarginMargin in the futures market is a lot different from margin in equities trading. In futures trading, margin is a deposit made with the broker in order to open a position. The amount is a fixed percentage—usually between 3% and 12%—of the notional value of the contract. There are no interest charges to the customer on futures margin because it is not a loan. |

|||||||||||||

Negative Balance Protection

What is the negative balance protection?Negative balance protection means that you can't lose more than your deposited money, i.e. you won't owe money to the broker. Let's say you deposit $1,000 to your account and you buy a share with 5:1 leverage. In this case, you will have a position of $5,000. If there is a market turbulence and your share price drops 7%, you will suffer a 35% loss due to your leverage. This is $1,750 loss in dollars. This loss will eat your $1,000 deposited money and a further $750 which you will owe to the broker. If you do this transaction at a broker which provides a negative balance protection, your loss can't be bigger than the deposited $1,000. |

|||||||||||||

| Phone Trading Available: | |||||||||||||

Social / Follow Trading

Social TradingSocial trading is a form of investing that allows investors to observe the trading behavior of their peers and expert traders. The primary objective is to follow their investment strategies using copy trading or mirror trading. Social trading requires little or no knowledge about financial markets, and has been described as a low-cost, sophisticated alternative to traditional wealth managers by the World Economic Forum. |

|||||||||||||

Spreads:

What is spread in Forex?It is basically the difference between buying and selling prices of the assets you are currently trading. For example, let’s imagine a USD/JPY trade. In this pair’s case, we are buying JPY with USD, so we need to calculate accordingly. The market is requesting a price of 109.77 JPY per USD, so we buy. There’s another person trying to sell his USD and he is seeing a price of 109.79 JPY per USD. Once the trade goes through each trader gets the according amount and the spread comes in to be at 2 pips. So 109.79-109.77= 0.02. But what is a spread in Forex trading? Why is there a gap between these prices? Well, it’s quite simple. The spread is usually an income source for the broker. Every broker has a “liquidity provider” who directs the trades to the market and helps both the broker and the trader make payouts.Those liquidity providers have their own spread as well, so if the broker wants to have at least some income, they either have to charge commissions on the traders, or mark the spread up. |

Variable Spreads | ||||||||||||

|

Trading Signals Provided

A forex signal is a suggestion for entering a trade on a currency pair, usually at a specific price and time. The signal is generated either by a human analyst or an automated Forex robot supplied to a subscriber of the forex signal service. Due to the timely nature of signals, they are usually communicated via email, website, SMS, RSS, tweet or other relatively immediate method. In many jurisdictions signal services need to be registered with the authorities. |

|||||||||||||

| Additionally | Swap Free Accounts ( Islamic Account) |

| Supported Languages: | English Česky, Deutsch, Español, Français, Magyar, Italiano, Nederlands, Polski, Português, Svenska |

| Support / Service Hours: | 24hrs/ 7 days |

| Live Online Support: | |

| Phone Trading Available: |

|

Deposit Bonus

When you decide to start trading Forex (FX) online, you will of course need to select a good broker. While traders will look for many useful features when choosing a Forex broker, they will also come across a lot of aggressive advertisements from various FX brokers, that will try to entice new traders with an attractive Forex deposit bonus.

n general terms, a bonus is simply a way of compensating traders for choosing a certain broker. Once a person has opened an account with a Forex broker, they will be trading currency pairs, and will have to incur the same expenses as any other trader. The bonus is just a way for the broker to reward the trader’s choice, and give all or some of these expenses back to the trader, once they have proven themself as an active one.

How Does a Forex Deposit Bonus Work? There are many bonuses offered by brokers, with some of them being given to you post-trading, and others being deposited to your account as soon as you have completed a deposit. Bonuses that are known as rebates are credited to your account once you have completed a trade, while regular bonuses may require you to carry out quite a number of trades first. So how does the Forex deposit work? As this is a deposit bonus, a trader has to of course make a Forex deposit via an account manager, after they have accepted the terms & conditions and have successfully applied. Usually, once the account has been deposited, it may take a few hours (or days, in some exceptional cases) to actually receive the bonus on your account. Once the bonus is there, a trader may start opening and closing positions with the aim to trade the required volume, in order to claim the bonus as their own property. Once a trader has completed the required volume, the bonus money can be transferred from the broker to the trader. After this, a person can do whatever they want with these funds. |

No |

| First Deposit Bonus How To Receive A Hefty Forex Deposit Bonus? Forex deposit bonuses come in different shapes and sizes. Although some Forex brokers offer large bonuses and promotions to rope in clients, Forex bonuses are usually not as popular as in other industries such as binary options trading, spread betting, and sports betting. Unlike gaming or gambling websites, Forex trading is a legitimate business idea that allows an investor to make informed decisions on the market and earn a stable and steady income. Although professional traders stay away from Forex bonuses, amateur, and intermediate traders may find bonuses to aid them in their journey towards building a successful trading portfolio. What Are The Usual FX Bonuses Available For Trading Forex deposit bonuses start from as low as 5% of the deposit amount to as high as 100% of the initial deposit. Some brokers also offer up to 200% or an even larger numbers, but a majority of mainstream brokers limit the amount of bonus to a 100% maximum. These bonus structures are usually dependent on the amount of deposit, the type of account, and the credibility of the broker. According to industry norms, trusted and reliable brokers often offer fewer bonuses when compared to other lesser-known brokers. On the other hand, the availability of a bonus or the lack of it alone is not entirely representative of the quality and reliability of an FX company. Some FX brokers also offer a free no-deposit bonus that allows traders to start trading without making an initial deposit. Such no-deposit bonuses are ideal for traders to enjoy a risk-free environment where they can evaluate the real-life results of their trading strategies without putting their hard-earned money on the line. No deposit bonuses are also excellent alternatives to demo accounts, as demo accounts are mostly incapable of replicating the actual emotions and psychology of trading on a large scale. No deposit bonuses start from $1 to as high as $1000; however, there might be several restrictions when it comes to withdrawing profits made through such bonuses. | No |

| Trader competitions |